Our permanent portfolio approach to investing

We closely monitor the events that can affect your wealth and have created a portfolio and process that protects it while providing stable returns.

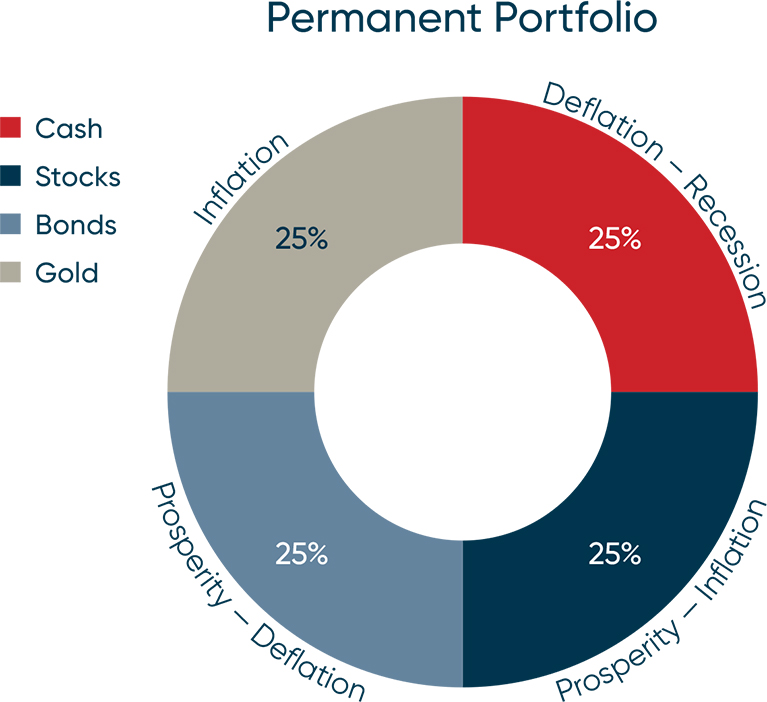

The Permanent Portfolio is our flagship asset-allocation strategy that we have been using for over 35 years that hedges all economic scenarios at the same time. These scenarios are inflation, deflation, prosperity, and recession.

The Permanent Portfolio has provided balanced and diversified portfolios that withstand different economic scenarios simultaneously to provide low volatility with consistent returns.

The Permanent Portfolio is an investment strategy introduced by Harry Browne in 1981. The Filipiuk Group has adapted this strategy (with great success) to modern investing while replicating its original methodology.

The Permanent Portfolio provides a stable and reliable investment approach that can withstand various economic conditions. The strategy involves diversification across four asset classes that are expected to perform well in different economic environments:

- Stocks (25%): Equities represent the growth component of the portfolio, which involves investing in a broad market index to capture overall stock market performance.

- Bonds (25%): Fixed-income securities hedge against deflation and economic downturns (such as government bonds) and provide stability and income.

- Gold (25%): Among precious metals, gold is considered a hedge against inflation and currency devaluation. Gold has historically retained its value during economic uncertainties.

- Cash (25%): A safety net that provides liquidity by taking advantage of buying opportunities during market downturns.

These asset classes are rebalanced several times each year,

selling assets that are performing well and buying assets that are

under performing to ensure they reach their optimal balance in the portfolio.

The purpose of this approach is to reduce the human error that can arise from trading at inappropriate times. Our approach has a 50-year track record that has provided growth with more stability than traditional portfolios.